We are moving into a new era for money. Paper notes are disappearing. Cash is going digital, and global stablecoins are at the forefront of this financial revolution.

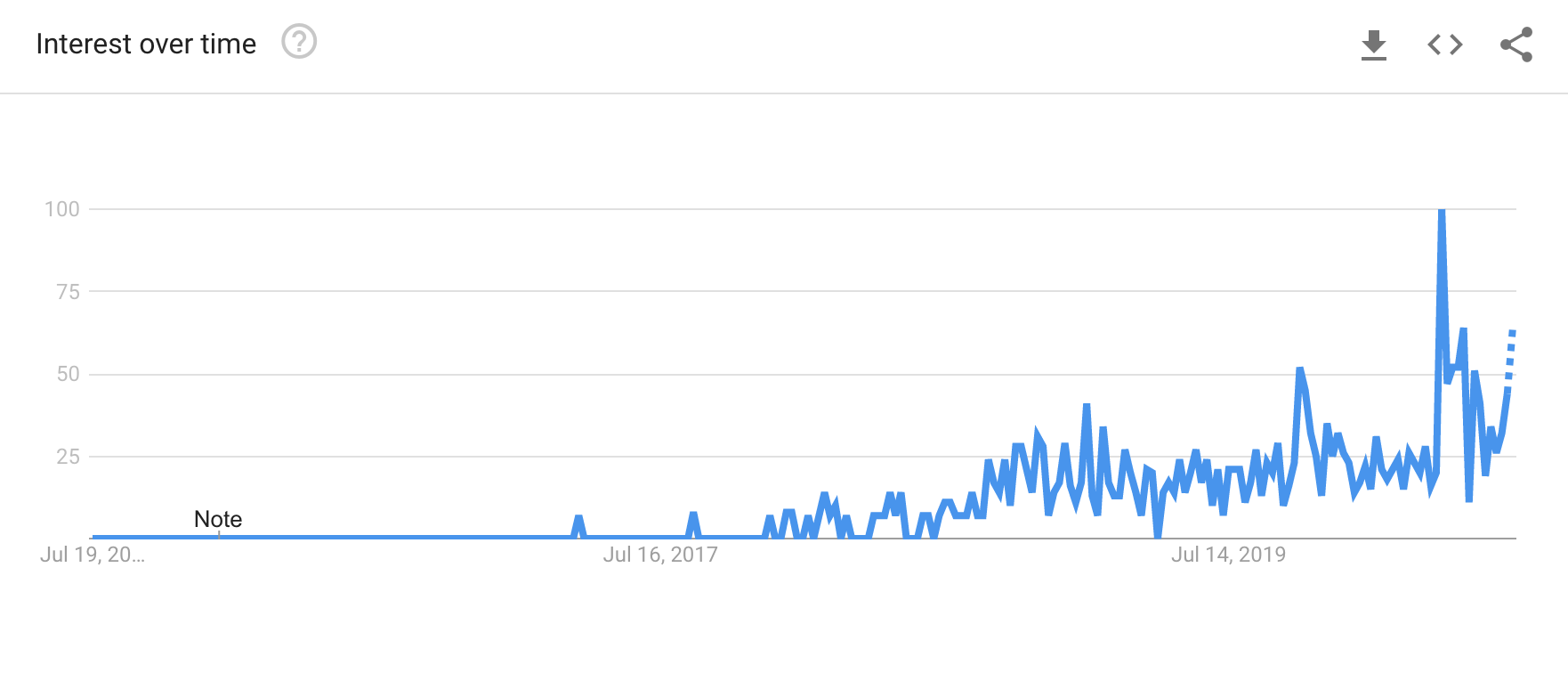

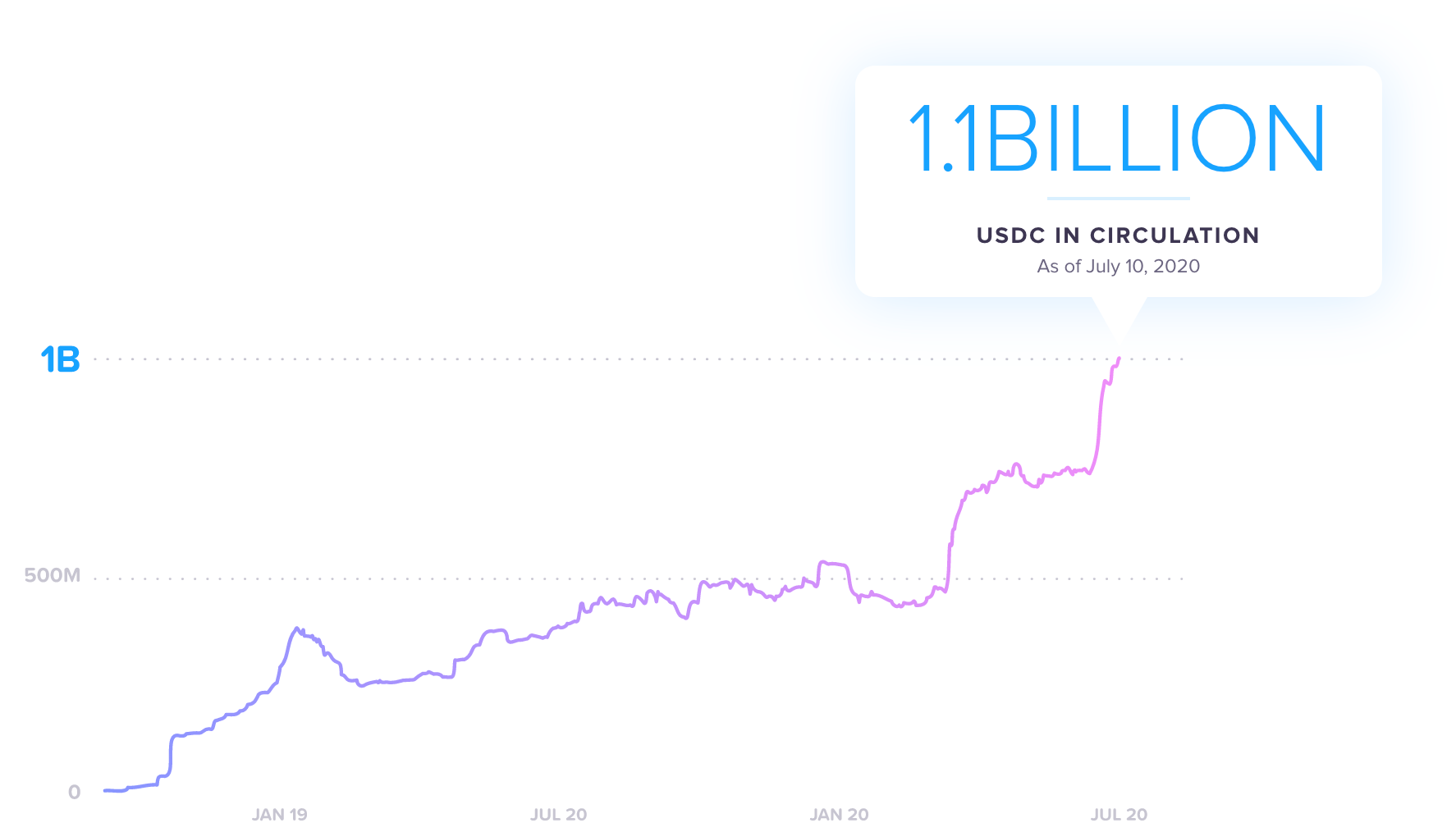

Interest in digital dollar stablecoins has exploded in the past twelve months, boosted by Facebook’s Libra initiative, China’s central bank digital currency efforts, and global demand for US dollars in the wake of the COVID-19 pandemic, which has led to a global economic crisis with significant currency volatility and increased counterparty risk. All of this has contributed to rising demand for stablecoins — USD Coin (USDC) in circulation has grown by almost 200% year to date to over 1 Billion.

Google Trends data on searches including the term "stablecoins".

Google Trends data on searches including the term "stablecoins".

But despite strong interest and ample media attention, there is still confusion about what full reserve digital dollar stablecoins are and why they are beneficial to businesses.

In this article, we'll focus on USD Coin (USDC) to explain what full reserve global stablecoins are, how they're being used, and how Circle is helping drive the revolution.

Global Stablecoins: the New Money

Digital currency and blockchain technology have evolved to a point where digital dollars can be sent to anywhere in the world in minutes; no banks, no money transfer operators, and no hassle.

Bitcoin was the first iteration of this revolutionary new type of money. Today, fiat-backed stablecoins, such as USD Coin (USDC), are taking the helm, enabling global value transfer in a way that is not possible with legacy payment systems.

USDC is the fastest-growing, fully reserved digital dollar stablecoin with over $1.1 billion digital dollars in circulation and over $58.7 billion transferred on-chain.

Early stablecoin use cases evolved around currency exchange and trading markets. But today, the power of digital dollar stablecoins is revolutionizing global payments and e-commerce.

For example, using the USDC stablecoin, a US-based manufacturer could pay a supplier in Brazil using digitized US dollars upon receiving ordered materials. The Brazilian company could then redeem the tokenized dollars, and receive fiat currency in its corporate bank account. Instead of waiting for days for an international wire transfer, the supplier in Brazil receives the payment within minutes.

“A core mission for Circle, and what we are doing with USDC, is to create a new protocol and a new format for digital money that works on the internet to enable people to make value transfers as effortlessly as possible,” said Circle CEO, Jeremy Allaire.

While cryptocurrencies are widely considered speculative assets, stablecoins provide the speed, security, and price stability that digital currency needs to be used as money.

USD Coin: Digital Money for the Digital Age

USD Coin (USDC) is a fiat currency-backed stablecoin issued by regulated financial institutions that enables anyone in the world to send and receive digital dollars. The stablecoin is redeemable on a 1:1 basis for US dollars and backed by fully reserved assets.

USDC is governed by Centre, a consortium that sets technical, policy, and financial standards for stablecoins. The US dollar reserves for USDC are subject to monthly attestation reporting from global auditing firm, Grant Thornton LLP.

The USDC stablecoin currently operates as an ERC-20 token on the Ethereum blockchain network, which means every transaction can be transparently viewed on the public ledger as the money from the sender to the recipient in real-time.

Additionally, USDC is in the process of becoming a multi-chain stablecoin to expand its reach and support a broadening range of use-cases for payments and financial apps. Circle and the Algorand Foundation have entered into a wide-ranging collaboration to bring USDC to the Algorand network.

Benefits of USDC

Since its launch in September 2018, USDC has established itself as a market-leading stablecoin with over $1 billion in circulation. The increase in USDC issuance is a testament to the market’s demand for new money that can be used in a more versatile and efficient way than legacy money.

The main benefits of USDC over traditional payment rails include:

- Open, accessible, and inclusive

- Near-instantaneous, global money transfers

- Low transaction fees compared to banking rails

- Transactional transparency in real-time

- Programmable money that can be used for auto-payments

USDC Use Cases

The number of use cases for the USDC stablecoin are myriad as it is a more open, inclusive, and accessible version of the US dollar.

The main use cases for Circle APIs include:

- Accept and make global payments

- Add digital dollar accounts

- Send mass payouts globally

- On- and off-ramps in your crypto product

The power of open, borderless blockchain based networks lies in their ability to process payments globally. USDC enables anyone in the world with an internet connection to accept and make global payments with ease.

USDC also provides businesses with the ability to add accounts so that they can send and receive digitized US dollar payments over the internet.

USDC can also be used by businesses to send mass payouts. Global internet marketplaces that work with stakeholders across the globe can use USDC to process payouts to anywhere in the world.

Finally, USDC also acts as an on- and off-ramp for crypto products that aim to leverage stablecoins. From DeFi protocols to gaming applications, USDC can be in a myriad of ways in the crypto ecosystem as a secure, price-stable digital asset.

Circle: Facilitating New Money

Circle is an issuer of USDC and a founding member of the Centre Consortium that manages the stablecoin. Beyond that, Circle has introduced a new global financial account for business and a suite of platform services that is empowering a broad ecosystem of financial institutions, fintechs, blockchain startups, and internet businesses to harness the power of digital dollar stablecoins.

Circle Business Accounts

Circle Business Accounts allow businesses and financial services companies of any size to use USDC as a new payment rail.

Business Account holders can connect and convert funds from 80+ countries into USDC and securely store, send and receive stablecoin payments.

Moreover, companies in over 150+ countries can enable their customers to pay with credit cards, debit cards, or bank transfers while receiving the funds in USDC.

Finally, all USDC held in Circle Business Accounts are securely stored and insured by an industry-leading insurance policy.

Platform APIs

Circle also offers a suite of APIs to enable developers to build next-generation applications for finance and internet commerce using stablecoin technology.

Currently, Circle provides three APIs powered by the USDC ecosystem:

- Payments API

- Wallets API

- Marketplaces API

Payments APIs enable businesses to integrate debit and credit card payments that automatically convert to and settle in USDC. As a result, businesses that do not have access to traditional banking relationships can bank in digital dollars in an easy and hassle-free manner.

Wallet APIs enable businesses to easily implement USDC wallet infrastructure into their existing product to accept stablecoin payments.

Marketplaces APIs are a combination of Circle’s payments and wallet API products that allow businesses to process pragmatic payments and payouts.

To enter the world of new money, sign up for a Circle Business Account today.