10 Stablecoin Myths, Busted

Download the pdfFollowing not one, but two public hearings on cryptocurrencies and stablecoins, it is clear there is still a knowledge gap on how these innovations are used and regulated in the U.S. and around the world. Important questions about consumer protection, financial inclusion, which critics often cite as a cynical fig leaf hiding the real motives of a greedy crypto industry, as well as responsible financial services innovation were raised in these hearings. While not all stablecoins are created equal, like blockchains and crypto-assets more generally, they represent important breakthrough innovations in how money moves around the world in an always-on global economy.

Arguably, the world is in a heated digital currency space race, where some countries are opting for centralized government-led digital currency projects, while others are relying on a whole of government approach spurring fintech and digital asset investments. Others still, the category in which the U.S. falls, are gaining ground due to the sum of free market activity riding on blockchains as a foundational technology — second only to the internet. To see this activity as an unregulated Wild West of internet banking and payments, misses the ways in which the U.S. states are (and have always been) the laboratory for financial services innovation in the country. Indeed, as the President’s Working Group on Financial Markets recently observed, stablecoins are now too big to ignore, but not yet too big to fail from a systemic risk point of view.

The public discourse about stablecoins, or dollar digital currencies in the case of USD Coin (USDC), labors under some common misconceptions. Here are some common myths and important clarifications on how stablecoins are regulated in the U.S. and how they may even enjoy a higher standard of consumer protection and prudential risk management than many mainstream banking, payments and financial services.

Myth one – “Stablecoins are an unregulated form of internet funny money reminiscent of the Wild West of the wildcat banking era.”

While it is true that the proliferation of cryptocurrencies and digital tokens (many remnants of the initial coin offering (ICO) bubble) has produced some suspect forms of “internet funny money,” to say all stablecoins are unregulated and unsafe is patently false. Circle and dollar digital currencies like USDC, are regulated across the U.S. on a comparable footing to major payments companies and innovations such as PayPal, Venmo, Apple Pay, among other globally trusted firms. State money transmission regulations, which govern USDC’s consumer protection and prudential standards, have clear statutes, including permissible investment restrictions designed to protect funds on customers’ behalf.

Additionally, many U.S. regulated stablecoins, whether they are issued under state money transmission rules or trust charters, conform with prevailing rules to counter illicit finance by registering with the Financial Crimes Enforcement Network (FinCEN) in the U.S. Department of the Treasury as a Money Services Business (MSB).

U.S. money transmission rules also have clear legal classification that applies to stablecoins, which reads as follows:

From the CSBS Uniform Money Transmission Modernization Act:

(aa) "Stored value" means monetary value representing a claim against the issuer evidenced by an electronic or digital record, and that is intended and accepted for use as a means of redemption for money or monetary value, or payment for goods or services. The term includes, but is not limited to, "prepaid access" as defined by 31 C.F.R. Section 1010.100, as amended or recodified from time to time. Notwithstanding the foregoing, the term "stored value" does not include a payment instrument or closed loop stored value, or stored value not sold to the public but issued and distributed as part of a loyalty, rewards, or promotional program.

Myth two — “Stablecoins are unreserved, illiquid, lack transparency and are backed by little more than false promises and internet vaporware.”

While not all stablecoins are created equal, perhaps demonstrating how the catchall term of art should be abandoned, the three year old innovation of USDC (a dollar digital currency) has always been backed by sufficient dollar referenced assets to ensure price parity with the dollar at all times. This economic stabilization fights the “buyer’s and spender’s remorse” that plagued early digital currencies. Today, standing at more than $40 billion USDC in circulation, the equivalent in cash and short-duration U.S. Treasuries (of 90 days or less) are held in the care, custody and control of U.S. regulated banks and financial institutions.

Notwithstanding the fact that state money transmission regulations allow for less conservative permissible investments of financial reserves backing money transmission companies, a stricter reserve management and liquidity profile has been adopted. This includes opportunities to allocate a share of reserves, perhaps accruing to billions of dollars over time, to community banks and minority depository institutions (MDIs) across the U.S. In effect, distrust in the dollar reserves backing USDC, would be tantamount to distrust of the U.S. regulated banking system. Even still, the opportunity to harmonize national regulations for stablecoins as critical financial markets infrastructure is a welcome policy development.

With regard to transparency and accountability, while it is not a requirement under money transmission rules to report on the sufficiency of reserves to meet demands for USDC outstanding, the unique nature of stablecoins calls for transparency and ongoing reporting. Since the first USDC entered circulation until today, monthly attestations on the sufficiency of dollar-denominated reserves to meet demands for USDC outstanding have been provided under the watchful eye of one of the world’s leading accounting firms. More than 36 such reports have been issued and are publicly available. Herein lies an area of policy opportunity, which would be to harmonize these reporting requirements for a broad mix of stablecoin issuers, irrespective of their regulatory structure. Overtime, as these standards are harmonized, policymakers should consider whether stablecoins meeting certain criteria for openness, prudential management and compliance can be classified as digital legal tender.

Myth three — “Stablecoins are only used as poker chips in the crypto trading casino.”

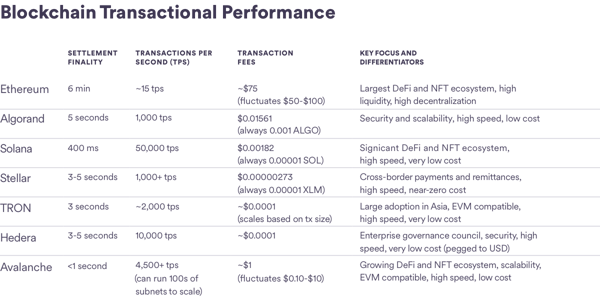

It is true that the bootstrap use case for stablecoins was supporting crypto capital markets and trading activities, including software-intermediated financial markets (DeFI and CeFI in crypto parlance). However, to say this is the only use or that enhancing consumer choice with wealth creating investments is somehow wrong, would be an erroneous statement. Indeed, the use of stablecoins in highly demanding and efficient internet trading markets has been a perfect proving ground for a fundamentally new payments innovation. After all, the price certainty, trading speeds, settlement finality and performance requirements of a now $3 trillion dollar digital-assets market, have driven wholesale improvements in the blockchain technology that underpins these markets, as well as the overall market experience — akin to the dial-up to broadband journey with the internet. In a word, the technology is not standing still and is increasingly fading to the background. This is especially true as purpose-built, high-throughput payment blockchains come on-line and are beginning to match the breakthrough innovation of trusted dollar referenced stablecoins, like USDC. As has been noted, electronic markets firms are perhaps the single-most demanding customers of dollar market infrastructure in the world, laying the proverbial fibre for the rest of the world to reap the benefits of this infrastructure for generalized payment utility.

Cumulatively USDC alone has been used for more than $1.5 trillion in on-chain transactions — a rounding error vis-à-vis the size of traditional markets, payments and trading infrastructure, but an important “trial run” of dollar digital currencies and third generation blockchains to support always-on financial needs. These tests in digital asset markets are starting to come out of beta and emerging late generation blockchains are beginning to enjoy transaction throughput and operational robustness akin to major retail-scale payment networks. Critically, transactional prices are already attaining pennies on the dollar cost structures.

The one distinction, however, is that rather than riding on proprietary technology, stablecoins rely on open source software and public blockchains and promote price-reducing competition and interoperability. Indeed, how useful would Gmail be if a Gmail user could not send an email to Hotmail or Yahoo? Today’s payment networks, no matter how efficient they may be for those so fortunate to be inside the walled garden, labor under a universal lack of interoperability and openness. Open, blockchain-based financial services (noting that the use cases are much bigger than banking and money) are changing this landscape for the better. In the three entanglements of the internet, web 1, 2 and 3 respectively, we went from merely being able to read content, to reading and writing (while creating tech titans in a few postal codes), to now having the opportunity to read, write and now own the very internet services we depend on.

Myth four — “Stablecoins and blockchain-based financial services have failed the financial inclusion test.”

The critics who argue stablecoins and blockchains hold a false promise of financial inclusion, notwithstanding the fact that many of these critics have had a monopoly on addressing the problem, forget that like dollars, digital currencies do not have agency. What they do enjoy, however, that physical dollars do not, is the extensibility and therefore comparatively lower costs of being internet native. This, combined with the consumer protections and price parity to the dollar mentioned above, means lower-cost, user-directed payments are now a possibility. Add in a growing merchant network and cash-in and cash-out points, including via major remittances companies, and stablecoins despite their novelty, may do more for financial fairness than many of the alternatives.

The world can no longer afford to merely admire problems of financial fairness, access and basic inclusion. What stablecoins and blockchain-based financial services demonstrate, as with past waves of breakthrough technology, is where incumbents, policy and regulations have fallen short. Herein lies the greatest defense of self-hosted digital wallets, which for some are an unacceptable form of risk in the financial system and for others a pathway of ensuring that billions of people are not left behind by the third wave of the internet. Of the 1.7 billion people around the world who are unbanked (added to nearly 1.3 billion who are under-banked), roughly a billion of them have access to a low-cost internet-connected mobile device. Returning for example the 7% average cost remittance transfers to the beneficiaries of these funds is not possible by today’s technological and competitive standards. Stablecoins, digital wallets and open blockchain-based networks are moving the needle on this UN Sustainable Development Goal, which calls for lowering remittance costs globally to 3%.

As is most often the case, traditional financial access exacts the highest costs from those who can least afford it. So if neither a physical dollar nor a digital currency (no matter how trusted) have agency, then why have stablecoins failed the financial inclusion test? Perhaps the people administering the test are afraid of competition or they gain usefulness and job security from barring the admission of challenger innovations that can genuinely democratize access to a global internet of value, like the internet of information before it? Because it is too early to cry failure and because challenges of systemic poverty and financial exclusion are born from forces conspiring against people, good actors must form uncommon coalitions and bend the arc of innovation in the favor of raising economic hopes and prosperity. The use of stablecoins in faster, corruption-resistant humanitarian aid (in the same way we no longer send a cross-border email) are already bearing fruit. This is just the beginning.

Myth five — “The use of stablecoins are trapped on expensive and risk-prone blockchain networks with high gas fees and little real world value or performance.”

Early flight was a perilous affair, sure to end in injury or death, just as early navigators were once warned of dragons on the horizon. The early internet may have well been called the world wide wait, for the slow speed and costs of analog dial-up. The noxious fumes of the internal-combustion engine have remained unchallenged for more than 100 years until very recently as companies like Tesla change the power plant propelling cars, without changing the nature of mobility. Stablecoins are to banking and payments, what Teslas are to the internal combustion engine.

The technology that underpins these innovations, however, are still in their early iterations, in which the openness and cyber resilience of the Bitcoin blockchain, was met with the programmability and smart contracts of the Ethereum blockchain. Both of which impose computational costs, gas fees (transaction costs that vary depending on network congestion, but also used as a form of cyber defense) and massive energy consumption that often defies the benefits of digital transformation, in which the second iteration of a product or service should have a fractional cost of zero.

The flaw in the argument that gas fees and inefficiencies in blockchains are prohibitively high and therefore they will never reach mainstream adoption ignores two major points. The first, because of the inexorable advance of Moore’s law and the collective endeavor of thousands of developers all over the world who are making a long bet with their time, talent and treasure on the $3 trillion crypto-assets market, is that technology is not standing still. The second, even with first generation blockchains, is that an entire generation of people have replaced the words In God We Trust, emblazoned on the U.S. currency, with In Code We Trust. The veritable internet of value is in the dial-up phase, but advancing quickly and with high-performing, low-cost and even carbon-neutral blockchains like Solana, Avalanche, and Algorand, which are beginning to reach scale.

In all, more than 200 million people around the world and more than 20 million in the U.S. are participating in this long bet, including people of color who have been historically locked out from traditional finance. They are not wrong, because the ladder of economic mobility that was once propped up with brick and mortar, must now be propped up with code, bits and bytes to extend the global perimeter of financial services. Indeed, because the sum of this creative destructive economic cycle is increasingly calling the U.S. home, notwithstanding the adversarial environment in some regulatory corners, the U.S. may be winning the proverbial digital currency space race. This leadership, however, is not assured if the internet of value is not able to safely exit the dial-up phase.

Myth 6 — “Stablecoins, like all cryptocurrencies, have no intrinsic value, yet if widely adopted pose monetary policy problems, even the specter of dethroning the dollar as the global reserve currency.”

In a world where public authorities have absolute sovereign power over money and monetary policy, the advent of cryptocurrencies, including stablecoins, has jarred some nerves among central bankers. Indeed, the sentiment among central bankers towards central bank digital currencies (CBDCs), changed from negative to positive with the advent of large technology projects proposing stablecoin solutions on globally accessible payment rails. Nevertheless, the argument that dollar-referenced stablecoins like USDC threaten monetary policy or, overtime, could erode the primacy of the dollar ring hollow.

For one, well-regulated stablecoins are issued without monetary policy or controls on circulation and redemption other than supply and demand factors. Moreover, from a macroprudential point of view, well-regulated dollar-referenced stablecoins are not participating in risk-inducing maturity transformation or leverage, which is the kindling in the fractional reserve banking system that on the one hand creates a money multiplier, but on the other is a multiplier of risk. Indeed, the dislocation of trillions of dollars post the 2008 Great Deleveraging that resulted in privatizing gain while socializing losses, was borne in no small measure from unchecked leverage.

There is no money creation with stablecoins like USDC. For well-regulated ones there is no leverage and, critically, dollar denominated reserves consisting of cash and short duration U.S. treasuries are held inside the very banking system prudential regulators supervise. This does not suggest that even the best run stablecoin arrangements are risk-free, for nothing in finance or the economy is. Rather, it does suggest a materially lower risk proposition that only adds value to the U.S. dollar in a competitive, always-on global economy. It is important to remember that virtually all value-added money in circulation today (M1 and M2) is in fact privately issued or rides of private sector rails, under the line of sight of public authorities. Well-regulated stablecoins and blockchain-based financial services protect and preserve this order and are contributing to the dollar being the currency of the internet, even in some loosely dollar referenced stablecoin arrangements that may pose systemic risk.

It stands to reason that stablecoin circulation would grow rapidly during the COVID-19 pandemic and the meteoric rise of digital assets and financial technology dependencies and innovations. Indeed, the pandemic accelerated global digital adoption by at least a decade in its first year. As with all payment system innovations, there is an upper bound on the size of financial reserves (or in a traditional payment company’s omnibus accounts), as adoption shifts from newly issued circulation to velocity of payments and transaction throughput. There is also a dynamic issuance and redemption process at play with stablecoins, which are bound by supply and demand factors. For example, since inception, there has been more than $96 billion USDC issued (minted in crypto parlance) and $57 billion redeemed (burned) demonstrating a well-functioning dynamic market with high liquidity.

Myth 7 — “Stablecoins are unnecessary because people enjoy low cost banking and CBDCs are on the horizon as a perfect fix for lower cost payments that preserve monetary sovereignty.”

Nearing the second year of the COVID-19 pandemic with global transmission set ablaze by the highly contagious Omicron variant, the world and U.S. in particular, faced nothing short of a Great Correction. Among the first pre-pandemic vulnerabilities that was revealed and exacerbated with quarantines, was our inability to move value over the internet at scale. The void of real-time open payment systems is a domestic and global security vulnerability. As the U.S., like other countries around the world, resorted to unprecedented government to citizen payments amounting to trillions of dollars of taxpayer funded interventions to stave off economic ruin, millions of households were left waiting often for months for analog physical checks and other slow, costly payments to arrive. This resulted in exacerbating the economic effects of the COVID-19 pandemic, but may have also contributed to $400 billion in losses due to fraud in the unemployment program.

While stablecoins alone, like other payment innovations, cannot solve whole of society challenges, promoting wide payment system optionality, including protecting and preserving the use of physical cash (which is incredibly useful and resilient when the lights go out and is the ultimate form of censorship-resistant money), increases consumer and market choice. Comparatively, many countries and regions with open banking laws, and or functioning fast payment systems and vigorously competitive mobile money, e-money and digital currency platforms fared better than the U.S. Mobile money platforms for example in China processed over $60 trillion in 2020 (up 25% compared to 2019) in transaction volume. Meanwhile millions of U.S. households still labor under the slow and costly death by 1,000 cuts environment of legacy payment options.

This lack of payment technology optionality also holds true for the back office environment of many mid-sized to small banks across the country. The reliance on a small handful of providers and their proprietary technology stack to run cross sections of the U.S. banking system is not only an example of vendor capture, it is a potential source of systemic risk that is currently unseen and unaccounted for. The advent of public blockchains that benefit from the thousand eyes of developers and ongoing open innovation, is a critical source of shared financial infrastructure without the prevalence of single sources of failure that should continue being developed, promoted, and incorporated into mainstream financial services across the U.S. Add to this shared risk reporting structures and methods of mutualizing the systemic costs of cyber risk, and a more resilient economic system is at hand.

For some, the only fix to this slow and expensive payment system with low levels of interoperability is a government-issued CBDC. The form factor of CBDCs and therefore the blueprint for how to do this well has yet to be agreed upon among 90% of the world’s central banks that are undertaking studies or pilots. A retail CBDC would be profoundly deleterious for the U.S. Indeed, this is one of the only areas where traditional banks, payments companies, fintechs, and stablecoin issuers have common cause. During recent hearings on CBDCs in the U.S. The anti-crypto Bank Policy Institute (BPI), and the American Bankers Association, both wrote long letters in opposition to this idea. Arguably, while the technological approaches to high throughput retail payments, or enhancements to FedNow are on the horizon, the policy, regulatory, cybersecurity and national economic competitiveness considerations of a government-issued digital dollar are far from settled.

Indeed, you could argue the advent of open dollar digital currencies are the greatest proxy for high throughput, high-trust digital dollars being uploaded onto the internet. The commutative transaction experience, combined with the mainstream adoption among competing payments companies and credit card networks, suggests that stablecoins are fast becoming an alternative settlement method — completing unfinished work in the financial system. This promotes competition and protects and preserves U.S. policies, values, and financial integrity norms in the emerging blockchain-based financial services market. Other critical points about CBDCs and their public policy risks must be considered and include the fact that even in a world where a CBDC was in wide circulation, it is fundamentally a domestic payments innovation rather than a global or cross-border medium of exchange.

Myth 8 — “Stablecoins like all cryptocurrencies are contributing to the rise of ransomware and illicit finance and should be banned.”

The false narrative that cryptocurrencies are contributing to a rise in cyber crime and illicit finance ignores the fact that email is a greater vector for cyber exploits and attacks than the method of digital thrift used to extract rents. This of course is to the extent the cyber attack has an economic motive in the first place. Yet, it would be absurd and unthinkable to have calls to ban email. With money, physical cash is literally a honey pot for corruption, bribery and fraud, yet calls to ban fiat money would be similarly absurd. No financial service or economic innovation is risk-free. Rather the good actors in the financial system work collaboratively to maximize the cost of illicit activity on its perpetrators, while enabling the freest use of money in all of its forms — whether enshrined on paper bills, metal coins, plastic cards or, with the emergence of cryptocurrencies, in tokenized form on blockchain ledgers.

Indeed, blockchains, in their maiden 12 years, have demonstrated the potential for exponential gains in financial integrity and combating bad actors. While many blockchain transactions are anonymous or pseudonymous, the permanent record keeping of public wallet addresses on the open internet has produced a novel industry of crypto forensics. The capabilities to track and trace illicit money flows from source to use in near real time is shifting the calculus of illicit activity against bad actors rather than penalizing every user in a financial system. This, coupled with the ability to train the eyes of the internet, including law enforcement and national financial intelligence units (FIUs) from around the world on suspect transactions and wallet addresses, are increasingly effective in detecting, preventing and retrieving illicit money flows. In the crypto assets market the costs on bad actors are increasingly high, while enabling greater participation from hundreds of millions of people around the world, including a growing wave of institutional adoption of the asset class and infrastructure.

Important companion innovations that enhance financial integrity such as the wave of crypto forensics companies like TRM Labs, Chainalysis and newer firms like Solidus Labs, which is geared for de-risking DeFI, are the veritable tripwires of the emerging internet of value. Other innovations in the digital identity, authentication, and verification domain are not far behind and collectively can contribute to a blue checkmark moment in crypto, while purging the bad actors (whose misdeeds are globally traceable) from the system. Indeed, if being banked depends on brick and mortar and know your customer requirements (KYC) being satisfied in tandem, then in addition to the 1.7 billion people who are currently unbanked, we would have to add the challenge of no universally portable national identification for more than a billion people. People born in the shadows without a nationally issued identification are confined to live on the margins of the formal economy, which is itself a source of profound risk.

Digital identity developments together with blockchain forensics can ensure responsible financial innovation, inclusion, and protecting the integrity of the global financial system are no longer seen as trade-offs, but rather as a global public-private imperative. In the post 9/11 financial crime compliance framework, the development of many of the technologies we now enjoy and take for granted, such as encryption, smart phones, public blockchains, state of the art financial forensic solutions, did not exist. As a result, national security trumped financial access for fear that even a small number of bad actors would make an errant transaction, entire continents were cut off from the financial system. The cost of de-risking made even well-intentioned banks and financial service providers reluctant to come up with new ways of serving the so-called base of the pyramid. The added costs of de-risking plus the slow pace of decoupling banking from brick and mortar made it infeasible to provide poor people with safe financial access.

Today, the confluence of competition, technology, public-private partnerships, and an integrated global community that are keeping a watchful eye on financial integrity, can provide a much more refined risk and compliance framework. The open and transparent nature of blockchain transactions, along with the ability to irrevocably record money flows, are providing new tools for combating illicit activity. Encouragingly, global bodies such as the Financial Action Task Force (FATF), and other financial integrity authorities, are beginning to question the efficacy of financial crime compliance standards and the blunt force nature of the current set of rules. Rather than having unintended consequences and financial exclusion, more dynamic risk-adjusted approaches to financial crime compliance can provide reasonable assurance to good actors, and no sanctuary or sanction for illicit activity. There is no question that having a digital fire brigade of blockchain forensics companies and developers building these firms inside the U.S., alongside compliant blockchain finance companies will improve security and competitiveness inside the U.S., and financial access around the world.

Myth 9 — “The cost of stablecoin transactions are actually worse than transactions using alternative methods, including analog ones.”

The argument that stablecoin payments are inefficient and costly, ignores the fact that many of the payments and transactions that are supported by stablecoins occur efficiently and at low cost because they are designed to settle on-chain. With USDC for example, $1.5 trillion in cumulative transactions have occurred on-chain. Where gas and other fees may arise is in times of high congestion or transaction volume on certain early blockchains, or in the “omni-chain” and omni-channel nature of the economic and commercial activity that is being supported on and in between new payment networks and traditional ones.

Here too, the fact that blockchain-based financial services, in contrast to proprietary technology approaches to payments and banking, are constantly upgradable is missed. This upgradability, may one day even support CBDCs, provided of course the major policy questions and risks are addressed. Open financial infrastructure that is being constantly improved in accordance with Moore’s law combined with the flywheel of network effects are gaining in efficiency, cost reductions, transaction throughput and security each year. This is an important feature and not a bug of emerging open source technologies.

These efficiencies are increasingly being transmitted to customers, and are a part of a growing competitive environment that is promoting more openness and accessibility for payments. Armed with a little more than a free digital wallet, consumers everywhere can enjoy low-cost, high-trust control over how they send, spend, save and secure their money. After all, is it really your money if you have to ask someone for permission to spend it and pay someone for its custody? At the same time a wave of open fintech entrepreneurialism is being spurred all over the world because of the open source nature of many of these innovations.

Myth 10 — “Stablecoins, cryptocurrencies and blockchains are an ecological disaster and a carbon-hungry energy vacuum.”

While the climate change scorecard of the early cryptocurrency wave is certainly checkered, to say that all cryptocurrencies, blockchains, and stablecoins are bad for the environment is patently untrue. Moreover, cryptocurrencies like bitcoin and the shift of mining activity to the U.S., is creating the early turns of a virtuous cycle where energy price arbitrage is shifting demand to renewable energy and continuous innovation in storage, immersion cooling and computational efficiencies. In a word, when it comes to crypto’s climate risk scorecard, the industry and its good actors are not standing still.

As an example, early blockchains such as Ethereum are shifting from proof-of-work (PoW), which has high computational intensity, to comparatively more efficient proof-of-stake (PoS) consensus models. This transition is expected to be completed early in 2022. Other technological innovations such as layer two blockchains and off-chain settlements, along with third generation blockchains that are purpose-built for payments, where some are carbon neutral, all mark major gains in a technology landscape that is not standing still.

The mainstream adoption of stablecoins in financial services will correspond first with arresting adverse environmental impacts of blockchain transactions (many of which are as energy efficient as an internet search), and eventually reaching a net-zero state. For now, as with other opportunity areas outlined above, technology on its own does not have agency, yet how it is harnessed and by whom (including whose values are enshrined in code) can produce net gains for humanity along an axis of social, environmental and economic factors. In a world roiled by so much turmoil and uncertainty, a foundational technology that can increase trust and ownership at the scale of the internet should be embraced in the U.S. and the U.S. dollar should be the currency of reference.

Conclusion

While many aspects of the blockchain ledgers that support stablecoin innovations are still in their proverbial dial-up phase, trillions of dollars in safe money transmission and settlement support a compelling counter narrative. Conclusively, this counter narrative that not all stablecoins are created equal and the catchall term, stablecoins, often misses important differences in how these cryptographic tokens are backed, used, regulated and growing. In the case of USDC and Circle, its sole issuer, this growth is occurring inside the U.S. and on a level playing field with major payments innovators, which supports the extensibility of the U.S. dollar as the currency for the internet. Facing the many criticisms that are levied against these innovations and blockchain finance more generally, perhaps the most compelling case to correct misconceptions begins with what people cannot do with their money when it rides on analog rails. Many of the banking, payments and global settlement networks are similarly overdue a system upgrade. If indeed the world is locked in a fierce digital currency space race (noting this is not a zero-sum competition), then open blockchain networks and the experience of dollar digital currencies like USDC are important pillars of U.S. economic competitiveness and security.