At Converge22, Circle announced new digital asset custody and crypto treasury capabilities to make it easier to run your business on-chain. Learn more.

Converge Dispatch is a blog series focused on exciting updates announced during Converge22, Circle’s inaugural crypto conference. See previous articles here, here and here.

The future of commerce is on-chain. At Converge22, Circle’s first ecosystem conference, we announced a wide range of product enhancements to help accelerate this future, from making USDC more accessible to simplifying Web3 development and bringing more digital currency payments to merchants. These announcements build off of our successful Circle Account launch from earlier this year, which we created as a home for both crypto-native commerce and for businesses beginning their transition on-chain.

Today, I would like to recap the new capabilities Circle is rolling out to make it easier for you to run your business in this dynamic, new environment that can offer incredible speed and cost advantages compared to legacy payments infrastructure — all without being unencumbered by traditional banking hours.

More businesses than ever are building on-chain, as the digital currency ecosystem shifts from speculation to commercial utility. This year’s Forbes Blockchain 50 is filled with globally recognized businesses and financial institutions that are investing real funds to evolve their blockchain strategies.

To serve these existing on-chain businesses and many more that we expect to migrate on-chain in the coming years, Circle is developing a platform that will soon be able to handle evolving needs across the entire business lifecycle. This platform is open, programmable and designed to co-exist with the larger traditional treasury ecosystem through APIs and standard protocols, so treasurers can harness both traditional and on-chain solutions together.

The building blocks of treasury

There are four key components to most treasury programs: Store, Pay, Invest and Borrow. In the near future, customers will be able to access these comprehensive capabilities all from within the Circle Account.

Let’s take a look at how we can help you address each.

Store — Circle helps businesses securely hold in custody and manage digital assets. It’s the most foundational aspect of our treasury platform. Using a Circle Account, you can mint and redeem USDC and Euro Coin almost instantly. We offer a Circle custodied wallet today, and will launch MPC custody with multi-asset support in 2023. Combining both models helps enhance flexibility in how you run your business — all through an account that’s secure and simple to use.

Pay — Paying vendors, employees and other counterparties and getting paid by customers are building blocks for every business. But payments are filled with friction, costs and complexities, especially when moving money across borders. Digital currency can move like other internet data — globally, almost instantly and at cheaper cost compared to traditional payment settlement. Our account infrastructure unlocks these benefits with a growing network of on and off ramp partners, stablecoin FX (coming in the future) and an address book to safely send funds with appropriate privacy and permissioning.

Invest — Putting idle working capital to work is another core component of treasury, and we are building a robust suite of options to help you earn returns* on funds you’re not actively using. Earlier this year, we launched our fully collateralized Circle Yield product with Circle as the counterparty to help businesses earn yield on their assets in a safe and secure manner. The product performed as designed through a turbulent market, a testament to our overall approach of stability, and a clear regulatory framework. We are also building out open-term options and access to third-party DeFi offerings from within Circle account infrastructure, both of which are expected to launch in the future. As of November 17, 2022, Circle Yield is not accepting new loans. We are evaluating future updates to the program.

Borrow — Access to capital is critical to business growth, and we’re building that into our platform as well. As we build out our infrastructure, we’re mindful of ways to help businesses get both short-term working capital and long-term debt. With digital currency capital markets evolving rapidly, we’re excited to announce more around this early next year.

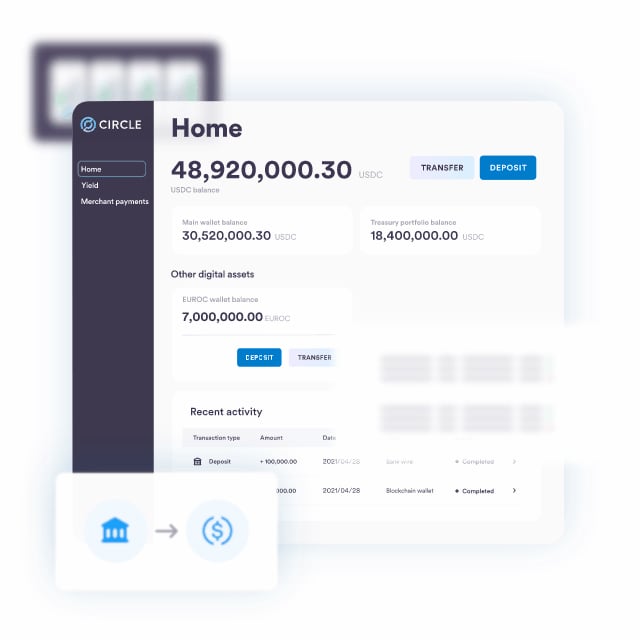

As an early step on this path, we recently updated the navigation of the Circle Account to better support our expanding suite of capabilities. This makes it easier to access the products you use today, while making it easier for us to build out the vision outlined above. Log in here and take a look at what’s new.

We are excited to bring these capabilities and more as we build out the Circle treasury platform. Stay tuned for updates to our strategy along with key product launches over the coming months.

* Offering subject to business approval, geographical availability, and regulatory authorization, and there is no guarantee that the product will become available in a specific timeframe or to a specific customer or geography. Circle Yield product offered through Circle International Bermuda Limited (“Circle Bermuda”). Circle Bermuda has entered into lending arrangements with one or more institutional borrowers. These borrowers pledge and transfer Bitcoin into custody with a third party custodian as collateral for their USDC borrowings and Circle Yield investors benefit from a security interest in Circle Bermuda’s security interest in the pledged Bitcoin.

Circle Account and money transmission services are provided by Circle Internet Financial, LLC (NMLS #1201441) and Circle Payments, LLC (NMLS #1415802). Circle Payments, LLC’s licensed activity is limited to fiat offerings in the state of California and is not inclusive of digital asset offerings. Circle Internet Financial, LLC is licensed as a Money Transmitter by the New York State Department of Financial Institutions and to engage in Virtual Currency Business Activity by the New York State Department of Financial Services. Massachusetts Foreign Transmittal Agency, FT1201441. Circle Bermuda is licensed by the Bermuda Monetary Authority and holds a Bermuda Digital Asset Business (DAB) License, No. 54786. A full list of Circle’s licenses can be found at /legal/us-licenses.

Circle is not a bank; your Circle Account is not a bank account, and any funds are not insured or protected by government compensation and/or regulatory protection schemes by the Federal Deposit Insurance Corporation, the Securities Investor Protection Corporation or by any US or foreign government agency, insurance fund, person or entity. For investors in the United States, investments described in this communication are offered by Circle Bermuda to “accredited investors” only in accordance with Regulation D, Rule 506(c) of the Securities Act of 1933, as amended. Neither the SEC nor any other regulatory body has approved or disapproved Circle Yield. While Circle Bermuda is regulated by the Bermuda Monetary Authority for digital asset business, Circle Bermuda is not engaged in banking and deposit taking activities and is not regulated for these purposes. You should carefully conduct your own investigations and analyses in connection with any participation in this product, including its objectives, risk factors, fees and expenses and the information set forth in these materials. All prospective participants in the products described herein are advised to consult with their legal, accounting and tax advisers regarding any potential participation. Tax may be payable on any return on and/or any increase in the value of your investment and you should seek independent advice on your taxation position. Please read the offering documents carefully before you invest. Additional information is available upon request.

Not currently available in the following U.S. states: Alaska, New York and Hawaii.

**Rates are purely indicative and are subject to change pending availability, approval and market conditions.