digital dollars in action

digital dollars in action

Institutional Traders, Market Makers & the Stablecoin Opportunity

The Growth of Stablecoins in the Crypto Markets

Stablecoins have had a profound impact on the crypto trading ecosystem. Before the emergence of global stablecoins, crypto market makers and professional investors had to juggle cumbersome fiat-to-crypto on and off-ramps every time they wanted to enter and exit a position.

Fortunately, stablecoins changed the game.

Following the launch of the first stablecoin in 2014, it took several years for stablecoins to become an integral part of the crypto trading ecosystem. It wasn’t until the bull market in 2017 that more exchanges started to adopt stablecoins as a base currency for the most popular cryptocurrency trading pairs.

However, the big stablecoin boom started in 2018 when several stablecoin projects — including USDC — emerged to offer more transparent and trustworthy alternatives than their predecessors. From January 2018 to July 2020, the stablecoin market ballooned from around $2 billion to over $11.5 billion in market value.

The three leading stablecoins — Tether USD, USDC, and Paxos Standard — make up over 90% of the stablecoin market and have a combined market capitalization of over $10 billion.

Today, stablecoins make up a large percentage of on-exchange BTC/USD trading volumes as crypto traders and market makers have switched from fiat currency to digital dollar stablecoins to trade in and out of bitcoin (and other cryptoassets.)

The highest-volume bitcoin trading pairs on leading exchanges Binance, Bitfinex, Huobi Global, OKEx, and Poloniex all contain a stablecoin as the quote currency.

In light of the benefits of using stablecoins over fiat currency in crypto trading, it should come as no surprise that stablecoin adoption has been booming among crypto traders.

In the chart above, you can see how daily trading volumes for the three largest stablecoins — USDT, USDC, and PAX — have increased from October 2018 to mid-July 2020.

How Market Makers Use Stablecoins

In the crypto markets, market makers are primarily composed of hedge funds, prop trading houses, OTC desks and algorithmic trading firms. They generate revenue by offering both sides of the trade for retail and institutional investors in the most liquid trading pairs on the largest digital asset exchanges.

For market makers, there are three critical use cases for stablecoins:

- As a base currency to move in and out of risky cryptoassets

- As trading capital

- As a counterparty settlement instrument

First and foremost, market makers use stablecoins as a base currency to move in and out of risky cryptoassets. Instead of having to convert crypto into fiat currency to trade in and out of bitcoin or other cryptoassets, they can seamlessly use a digital dollar stablecoin. Not only are stablecoin trading pairs among the most liquid in the market, but the time it takes to transfer funds on and off exchanges takes minutes instead of the days it can take when using traditional fiat on and off-ramps.

Market makers also use stablecoins as trading capital and to store funds overnight. Instead of keeping funds in fiat currency on a bank account where fund transfer can take days, many professional traders choose to store their trading capital in stablecoins so that they can deploy new strategies quickly on a global basis.

Additionally, stablecoins act as a counterparty settlement instrument. Instead of having to wait for a wire transfer, settlement via stablecoins only takes a few minutes, and each transaction can be transparently viewed on a public ledger in real-time, with low costs, high-security and irreversible settlement, which altogether make their use far superior to international wire transfers.

Stablecoins in Lending & DeFi: A New Revenue Opportunity for Market Makers

Digital dollar stablecoins have established themselves as highly popular assets in the fast-growing DeFi and institutional crypto lending market, providing a new opportunity for market makers to earn yield on their crypto holdings.

DeFi, short for decentralized finance, refers to smart contract-powered protocols that replicate traditional financial services in an open, accessible, and decentralized manner. Using DeFi protocols, traders and investors can borrow, lend, trade, and invest cryptoassets to boost their earning capabilities in the cryptoasset ecosystem.

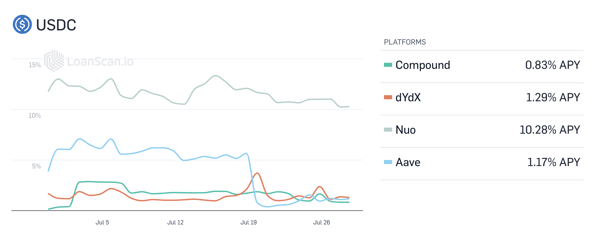

https://loanscan.io/earn/historical (Rates from July 22, 2020)

For example, a market maker could tokenize US dollars to convert them into USDC, and then deposit the USDC in the Compound Protocol to earn 1.70% APY to generate additional income through lending to complement their market-making activities. Interest paid in DeFi lending protocols is typically higher than the interest you would earn on US dollars held in a bank account, so it provides an easy avenue to increase revenues.

The DeFi market also creates new income opportunities to potentially earn exceptionally high yields. For example, yield farming — a new trend involving putting cryptoassets to work DeFi protocols — provides market makers with an entirely new opportunity to generate revenue.

Liquidity mining — one of the most popular forms of yield farming — involves providing liquidity to DeFi protocols, such as Balancer, Compound, and Synthetix, in exchange for freshly “mined” protocol tokens. For example, a market maker can provide USDC liquidity in a Compound money market to earn COMP, the protocol’s governance token. The COMP token is earned by liquidity providers in addition to the yield on the deposited asset. Some “yield farmers” go as far as lending one digital dollar stablecoin while borrowing another to earn more COMP to generate a higher return than the interest rate differential between the two stablecoins.

For institutional market participants, CeFi lending services are also booming. CeFi standards for Centralized Finance (vs. DeFi) in that the underlying credit markets (lenders and borrowers) are managed by a centralised, regulated financial intermediary such as a crypto prime broker. Market makers can lend stablecoins such as USDC, and borrow in USDC for putting on long positions in crypto markets. Products like Circle Yield can generate up to 6%* APY, and unlike borrowing in US dollars, a USDC loan settles within minutes and can be repaid just as fast due to the on-chain nature of stablecoin transactions.

As of November 17, 2022, Circle Yield is not accepting new loans. We are evaluating future updates to the program.

“More and more investors think of [a stablecoin] like USDC and the dollar as the same thing, and given the regulatory status of USDC and its audited nature, there is growing confidence that one USDC is a one dollar in your bank account.”

Genesis Trading CEO, Michael Moro, explained on The Money Movement. As a result, USDC lending has grown substantially since the institutional lender has started offering the stablecoin as a lending asset.

USDC: The Go-To Stablecoin for Crypto Market Makers

USDC is backed by fully reserved assets and issued by regulated financial institutions. All US dollar reserves for USDC are subject to monthly attestation reporting from leading auditing firm, Grant Thornton LLP.

By focusing on trust, transparency, and accountability, USDC has managed to grow into a market-leading stablecoin with over 3 billion in circulation. USDC also provides the price stability and liquidity needed for market makers moving in and out of large positions, reducing the risk of slippage.

Finally, Circle offers an array of platform services that enable market makers to integrate USDC into their trading infrastructure.

Sign up for Circle Mint

The easiest, free way for global businesses to realize the power of USDC.

Circle: A Home Base for Crypto Market Makers

Circle provides a product suite that can act as a home base for market makers who want to move in and out of risky assets while holding their trading capital securely in digital dollars.

The Circle product suite provides a full-service infrastructure for market makers to use USDC as trading capital, as a base currency, and as a settlement instrument.

Circle Mint

Circle Mint enables professional traders to securely store, send, and receive on-chain stablecoin payments to and from digital asset exchanges within minutes. Additionally, account holders can easily convert bank account balances into USDC and vice versa, conveniently integrating financial services.

Market makers can utilize Circle Mint as a hub to store their trading capital overnight as opposed to keeping it in exchange wallets or having to cash out into fiat currency at the end of each trading day. Maintaining trading capital in a digital dollar stablecoin also alleviates the need to conduct multiple wire transfers to and from crypto exchanges throughout the day. Instead, on-chain stablecoin transactions can be used to move trading capital on and off exchanges within minutes.

Circle APIs

Circle also offers an array of APIs connected to Circle Mint that traders can use to integrate USDC flows into their trading infrastructure. Use of the API essentially means that traders can control their flows from fiat to USDC anywhere (and back) from within their own infrastructures. These APIs enable market makers to automate wire transactions with USDC conversion.

|

AccountsAccounts allows market makers to create a multitude of sub-wallets under their Circle Mint account, relying on Circle’s custody and ledger to segregate funds flows in any way that’s required for their business processes. These APIs provide powerful tools for OTC desks who need to store balances by counter-party and manage on-chain settlement flows on an account by account basis. |